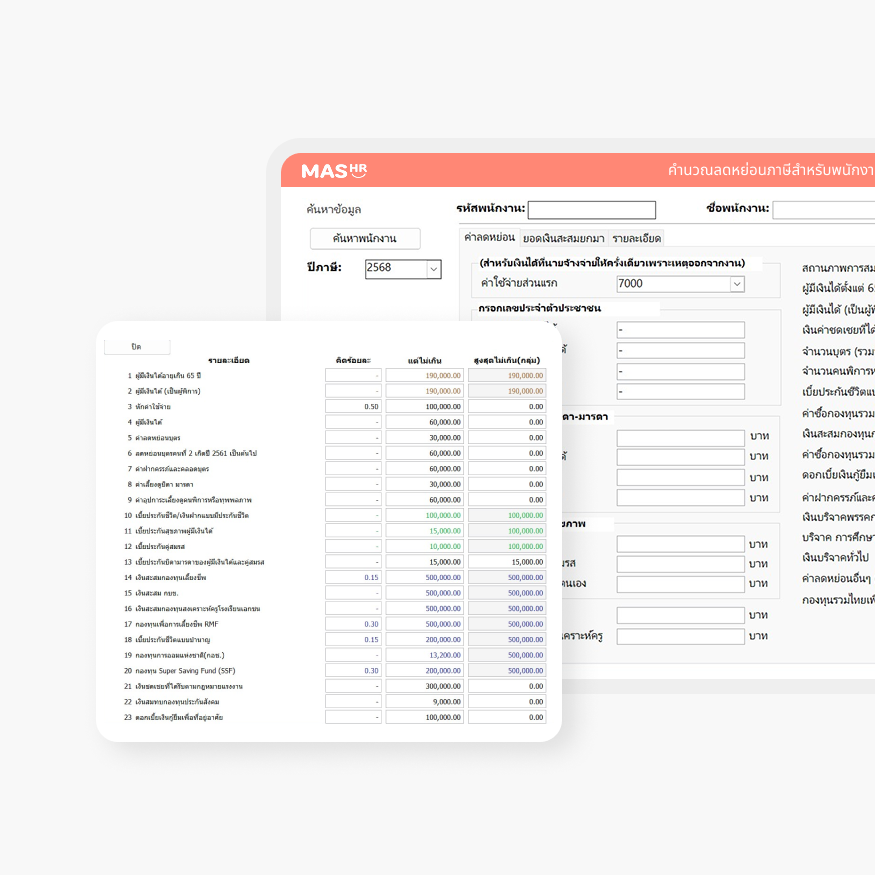

รายรับ

จัดการเงินเดือน ค่าคอมมิชชั่น โบนัส และรายได้เสริมอื่น ๆ อย่างเป็นระบบ

ทำให้การจ่ายเงินเดือนเป็นเรื่องง่าย สะดวก และรวดเร็ว

ด้วยฟังก์ชันการคำนวณที่แม่นยำสมบูรณ์แบบ

Certified Tax and Customizable App

ให้ผู้เชี่ยวชาญดูแลกระบวนการทำเงินเดือนแทน เรามีบริการรับทำเงินเดือน

ที่ทำงานบนระบบเดียวกับที่คุณใช้งาน ช่วยลดความผิดพลาด เพิ่มความถูกต้อง และส่งต่อข้อมูลแบบเรียลไทม์

Accurate tracking of working hours, shifts, and overtime, seamlessly synced to Payroll system.

ExploreDiscover our mission, products, and technology that empower digital transformation for modern workplaces across Thailand.

About us