Payroll Outsourcing

We Run Payroll, So You Can Run Your Business.

บริการรับทำเงินเดือน

จัดการเงินเดือนอย่างมืออาชีพ เพื่อองค์กรที่มั่นคง

บริการจัดทำเงินเดือนแบบครบวงจร(Payroll Outsourcing) เพื่อช่วยให้องค์กรของคุณดำเนินงานด้านเงินเดือนได้อย่างมีประสิทธิภาพ ครอบคลุมการคำนวณเงินเดือนอย่างแม่นยำ การปฏิบัติตามข้อกำหนดด้านภาษี การสำรองข้อมูลด้วยความปลอดภัยสูง และการจัดทำรายงานที่ครบถ้วน เพื่อให้องค์กรดำเนินงานได้อย่างราบรื่น พร้อมประหยัดเวลาและทรัพยากร

"ลดภาระงานด้านเงินเดือน ด้วยบริการ Payroll Outsourcing ที่แม่นยำ ปลอดภัย และพร้อมใช้งานทันที”

ประมวลผลอัตโนมัติทุกขั้นตอน

การประมวลผลด้วยเทคโนโลยีเพื่อดำเนินการทุกขั้นตอนของการจัดการเงินเดือนโดยอัตโนมัติ

ตั้งแต่การรวบรวมข้อมูลเวลาทำงาน การคำนวณค่าจ้าง การหักภาษีและประกันสังคม

ไปจนถึงการจ่ายเงินและการจัดทำรายงานครบถ้วนทุกบริการ มั่นใจทุกขั้นตอน ตรงตามมาตรฐานสรรพากรอย่างมืออาชีพ

ตั้งแต่การรวบรวมข้อมูลเวลาทำงาน การคำนวณค่าจ้าง การหักภาษีและประกันสังคม

ไปจนถึงการจ่ายเงินและการจัดทำรายงานครบถ้วนทุกบริการ มั่นใจทุกขั้นตอน ตรงตามมาตรฐานสรรพากรอย่างมืออาชีพ

กการบันทึกเวลาทำงาน (Time Tracking)

ดึงข้อมูลจากเครื่องลงเวลา/ระบบ ESS โดยอัตโนมัติ

การคำนวณเงินเดือน (Salary Calculation)

รวมค่าจ้างพื้นฐาน OT โบนัส และหักภาษี/สวัสดิการ

การจ่ายเงินเดือน (Disbursement)

ส่งข้อมูลไปยังธนาคารหรือระบบโอนเงินโดยตรง

การจัดทำรายงานและเอกสาร (Reporting & Payslips)

สร้างรายงานเงินเดือน ใบจ่ายเงิน และเอกสารภาษีแบบอัตโนมัติ

การจัดเก็บและตรวจสอบย้อนหลัง

(Audit & Compliance)

(Audit & Compliance)

บันทึกประวัติการดำเนินการเพื่อใช้ในการตรวจสอบและปฏิบัติตามข้อกำหนด

การบันทึกเวลาทำงาน

การบันทึกเวลาทำงานสามารถดำเนินการได้ทั้งแบบออนไลน์ผ่าน Mobile Application และแบบออฟไลน์ผ่าน

เครื่องสแกนที่ใช้งานอยู่ในปัจจุบัน เช่น เครื่องสแกนลายนิ้วมือหรือใบหน้า โดยข้อมูลที่บันทึกสามารถนำเข้าสู่ระบบกลาง

เพื่อใช้ในการประมวลผลและคำนวณ จัดการข้อมูลพนักงานโดยอัตโนมัติ

เครื่องสแกนที่ใช้งานอยู่ในปัจจุบัน เช่น เครื่องสแกนลายนิ้วมือหรือใบหน้า โดยข้อมูลที่บันทึกสามารถนำเข้าสู่ระบบกลาง

เพื่อใช้ในการประมวลผลและคำนวณ จัดการข้อมูลพนักงานโดยอัตโนมัติ

บันทึกเวลาออนไลน์ ด้วย Mobile App

ระบบบันทึกเวลาทำงานผ่าน Mobile App ช่วยให้พนักงาน

Check-in / Check-out ได้ทุกที่แบบ Real-Time

เหมาะสำหรับงานภายนอกออฟฟิศหรือรูปแบบทำงานที่ยืดหยุ่นรองรับ GPS

เพื่อยืนยันตำแหน่ง เพิ่มความถูกต้องและความปลอดภัย ข้อมูลถูกส่งเข้า

Time Attendance ทันที เพื่อคำนวณเวลาทำงานและรายงานได้อัตโนมัติ

Check-in / Check-out ได้ทุกที่แบบ Real-Time

เหมาะสำหรับงานภายนอกออฟฟิศหรือรูปแบบทำงานที่ยืดหยุ่นรองรับ GPS

เพื่อยืนยันตำแหน่ง เพิ่มความถูกต้องและความปลอดภัย ข้อมูลถูกส่งเข้า

Time Attendance ทันที เพื่อคำนวณเวลาทำงานและรายงานได้อัตโนมัติ

ข้อมูลบันทึกเวลาจากเครื่องสแกน

ระบบบันทึกเวลาผ่านเครื่องสแกน Biometric

เป็นวิธีที่มีความแม่นยำและปลอดภัยสูง เหมาะสำหรับองค์กร

ที่ต้องการควบคุมการเข้า-ออกงานอย่างมีประสิทธิภาพ

ข้อมูลจะถูกบันทึกพร้อมวัน-เวลา และรหัสพนักงาน ระบบจะดึงข้อมูลเข้าสู่ฐานข้อมูลกลาง ระบบคำนวณเวลาทำงานอัตโนมัติ และสามารถออกรายงานได้ทันที

เป็นวิธีที่มีความแม่นยำและปลอดภัยสูง เหมาะสำหรับองค์กร

ที่ต้องการควบคุมการเข้า-ออกงานอย่างมีประสิทธิภาพ

ข้อมูลจะถูกบันทึกพร้อมวัน-เวลา และรหัสพนักงาน ระบบจะดึงข้อมูลเข้าสู่ฐานข้อมูลกลาง ระบบคำนวณเวลาทำงานอัตโนมัติ และสามารถออกรายงานได้ทันที

การบันทึกเวลาทำงาน

การคำนวณเบี้ยขยันและสวัสดิการสามารถตั้งเกณฑ์ได้ตามนโยบายองค์กร

โดยพิจารณาจากความมีวินัยและประสิทธิภาพในการทำงาน พร้อมผนวกเข้ากับระบบเงินเดือนเพื่อจ่ายอัตโนมัติ

โดยพิจารณาจากความมีวินัยและประสิทธิภาพในการทำงาน พร้อมผนวกเข้ากับระบบเงินเดือนเพื่อจ่ายอัตโนมัติ

การคำนวณเบี้ยขยันแบบมีเงื่อนไข

ระบบสามารถกำหนดเกณฑ์การจ่ายเบี้ยขยันได้อย่างยืดหยุ่น

โดยอิงจากเวลาการมาทำงาน อัตราที่กำหนด และกลุ่มพนักงานที่ได้รับสิทธิ์

รองรับการกำหนดอัตรา คงที่ และ ขั้นบันได ระบบประมวลผลอัตโนมัติ พร้อมรายงานเพื่อตรวจสอบ

โดยอิงจากเวลาการมาทำงาน อัตราที่กำหนด และกลุ่มพนักงานที่ได้รับสิทธิ์

รองรับการกำหนดอัตรา คงที่ และ ขั้นบันได ระบบประมวลผลอัตโนมัติ พร้อมรายงานเพื่อตรวจสอบ

สวัสดิการที่เป็นเงินได้พิเศษแบบมีเงื่อนไข

นอกเหนือจากเงินเดือนและค่าจ้างประจำ พนักงานอาจได้รับสวัสดิการ

ในรูปแบบเงินได้พิเศษ ซึ่งมีเงื่อนไขการได้รับตามนโยบายขององค์กร

โดยมีวัตถุประสงค์เพื่อส่งเสริมพฤติกรรมที่ดีในการทำงานและสร้างแรงจูงใจ

สามารถตั้งค่าเงื่อนไขการได้รับในระบบ HR ได้อย่างละเอียด

ระบบจะตรวจสอบข้อมูลจาก Attendance, Performance, หรือเอกสารประกอบ

คำนวณและรวมยอดในรอบจ่ายเงินเดือนโดยอัตโนมัติ

สามารถออกรายงานสรุปการจ่ายสวัสดิการรายบุคคลหรือรายกลุ่ม

ในรูปแบบเงินได้พิเศษ ซึ่งมีเงื่อนไขการได้รับตามนโยบายขององค์กร

โดยมีวัตถุประสงค์เพื่อส่งเสริมพฤติกรรมที่ดีในการทำงานและสร้างแรงจูงใจ

สามารถตั้งค่าเงื่อนไขการได้รับในระบบ HR ได้อย่างละเอียด

ระบบจะตรวจสอบข้อมูลจาก Attendance, Performance, หรือเอกสารประกอบ

คำนวณและรวมยอดในรอบจ่ายเงินเดือนโดยอัตโนมัติ

สามารถออกรายงานสรุปการจ่ายสวัสดิการรายบุคคลหรือรายกลุ่ม

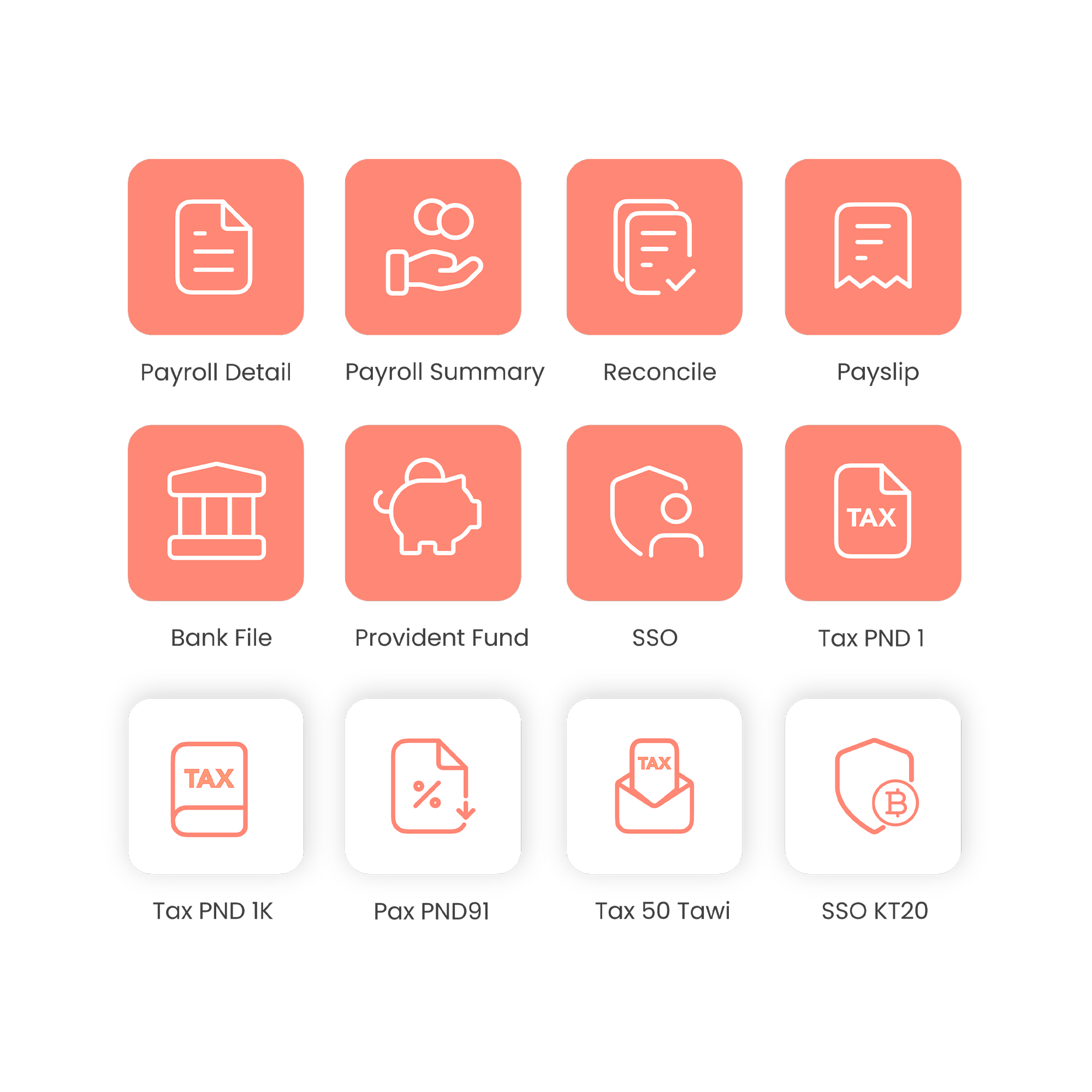

การจัดทำรายงาน

การจัดทำรายงานเงินเดือนเป็นหัวใจสำคัญของบริการ Payroll Outsourcing โดยต้องครอบคลุมข้อมูลที่ถูกต้อง ชัดเจน

และสามารถตรวจสอบย้อนหลังได้ เพื่อรองรับการจ่ายเงินเดือน การยื่นภาษี และการส่งข้อมูลให้หน่วยงานภายนอก

และสามารถตรวจสอบย้อนหลังได้ เพื่อรองรับการจ่ายเงินเดือน การยื่นภาษี และการส่งข้อมูลให้หน่วยงานภายนอก

รายงานสรุปเงินเดือน (Payroll Summary)

รายการเงินเดือนสุทธิ, รายได้, รายหัก, ภาษี, ประกันสังคม

รายงานจ่ายเงิน (Bank Transfer Report)

รายชื่อพนักงาน, เลขบัญชี, ยอดโอน, ธนาคาร

รายงานภาษีหัก ณ ที่จ่าย (PND1, ภ.ง.ด.1)

รายการภาษีที่หักจากพนักงานแต่ละคน

รายงานประกันสังคม (สปส.1-10)

รายชื่อพนักงาน, เงินสมทบ, รหัสสาขา

รายงานเปรียบเทียบรอบเดือน (Variance Report)

เปรียบเทียบยอดจ่ายระหว่างเดือน

รายงานสลิปเงินเดือน (Payslip)

รายละเอียดรายรับ-รายหักรายบุคคล

Application & Technology

การใช้เทคโนโลยีและแอปพลิเคชันช่วยประมวลผลเงินเดือนช่วยให้การทำงานมีความแม่นยำ

รวดเร็ว ปลอดภัย และสามารถเชื่อมโยงกับระบบอื่นได้อย่างมีประสิทธิภาพ

รวดเร็ว ปลอดภัย และสามารถเชื่อมโยงกับระบบอื่นได้อย่างมีประสิทธิภาพ

โปรแกรมเงินเดือน

ลดเวลาในการประมวลผลเงินเดือน

ลดความผิดพลาดจากการทำงานด้วยมือ

เพิ่มความโปร่งใสและตรวจสอบย้อนหลังได้

รองรับการเติบโตขององค์กรแบบหลายบริษัท/หลายสาขา

ลดความผิดพลาดจากการทำงานด้วยมือ

เพิ่มความโปร่งใสและตรวจสอบย้อนหลังได้

รองรับการเติบโตขององค์กรแบบหลายบริษัท/หลายสาขา

ระบบจัดการเวลาทำงานออนไลน์

เชื่อมต่อกับระบบบันทึกเวลา เพื่อดึงข้อมูลเข้า Payroll อัตโนมัติ

ลดการทำงานซ้ำซ้อนและเพิ่มความแม่นยำในการคำนวณ

ลดการทำงานซ้ำซ้อนและเพิ่มความแม่นยำในการคำนวณ

Mobile Application

Mobile App สำหรับพนักงานเป็นเครื่องมือสำคัญที่ช่วยให้พนักงานสามารถ

เข้าถึงข้อมูลส่วนบุคคลและบริการต่าง ๆ ได้อย่างสะดวก รวดเร็ว และปลอดภัย

เข้าถึงข้อมูลส่วนบุคคลและบริการต่าง ๆ ได้อย่างสะดวก รวดเร็ว และปลอดภัย

การจัดเก็บและสำรองข้อมูล

การจัดเก็บและสำรองข้อมูลบนคลาวด์ (Cloud Storage & Backup)

เป็นแนวทางที่องค์กรยุคใหม่เลือกใช้เพื่อเพิ่มความปลอดภัย ความยืดหยุ่น

และความสามารถในการเข้าถึงข้อมูลจากทุกที่ทุกเวลา

เป็นแนวทางที่องค์กรยุคใหม่เลือกใช้เพื่อเพิ่มความปลอดภัย ความยืดหยุ่น

และความสามารถในการเข้าถึงข้อมูลจากทุกที่ทุกเวลา

ความปลอดภัยและการปฏิบัติตามกฎหมาย

การควบคุมสิทธิ์ (Role-Based Access) รองรับข้อกำหนดด้านกฎหมาย

กำลังมองหา

โปรแกรมทำเงินเดือน

อยู่หรือไม่?

ทำให้การจ่ายเงินเดือนเป็นเรื่องง่าย สะดวก และรวดเร็ว

ด้วยฟังก์ชันการคำนวณที่แม่นยำสมบูรณ์แบบ

Time & Attendance

Accurate tracking of working hours, shifts, and overtime, seamlessly synced to Payroll system.

ExploreAbout ControlA

Discover our mission, products, and technology that empower digital transformation for modern workplaces across Thailand.

About us